For banks and credit unions, search ads are all about intent. More than any other digital channel, search ads allow banks to target prospects who are actively researching financial services with the intent to purchase.

When people use search engines like Google to research banking products and services (e.g., "best mortgage rates," "credit union near me"), they often have a specific intent in mind. They are actively seeking information and are more likely to convert into customers.

Targeting High Intent Searches

Prospects often pass thru a series of phases, or a funnel before finally becoming a customer. Most search volume comes from people who are in the early phases and only passively interested. Many are just doing research and do not intend on purchasing in the near future.

Since you are only charged for clicks, you want to avoid appearing for searches that are not likely to be prospects. We do this by only appearing for Commercial and Transactional searches at the bottom of the funnel where you have a high level of commercial intent.

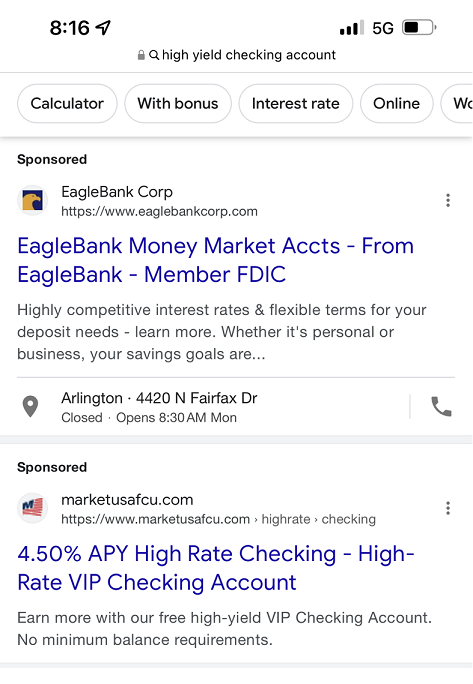

Here are examples of commercial or transactional search terms that you should target for a checking account offer….

These include action-oriented terms like “open bank account online” or “apply for a checking account.”

Local Intent makes it clear that the searcher is both in the market a banking product and seeking a local provider. Examples include “banks near me with free checking,” and “free checking accounts in Chicago.”

Matching Products and Features. If both the product an specific key features are included in the search, then you may decide that there is enough intent to target the term. Examples include “high rate checking account” and “high yield bank account.”

There are several categories of related search terms that banks should avoid. This first category includes searches that are vague or lacking intent. Examples include “internet bank account” or “online checking.”

Searches that lack purchasing intent and appear to be research or purely informational should be avoided. Examples include “joint bank account” or “best bank account for teens.”

Likewise, If you are not careful your ads will appear for searches that are related but inappropriate. Examples include “deposit checks online” and “bank account bonus.”

You need to make sure your ads don’t appear when the search includes features that don’t match your offer. If your checking account includes fees, then your ad should not appear for searches that include the word “free.”

In this example, we have included “free” as a negative keyword. This prevents our ad from appearing for any search that includes the word free.

Searches that include competitor brand names should be avoided. The user's intention is usually to get to the competitor's site. A large percentage of the clicks that you get will be accidental and it will waste your budget. If you look at the large search volume for these terms, you'll see that you can easily waste a lot of money if you are not careful.

Here you can see the list of negative words and phrases that prevent our ad from appearing. Our firm maintains lists with thousands of negative keywords to keep our ad spending focused on the right searches.

Campaigns are tightly focused around specific financial products/services

It's important that ads be aligned around a single product line. Mortgage-related searches brings up a mortgage, ad which leads to a mortgage landing page.

The same is true for any other product line that is running concurrently like Retirement Planning or Business Checking accounts.

Location Targeting for Financial Services: Niche Products vs Standard Products

Niche Products can be targeted nationally. Examples include…

- Lending for specific industries or occupations (agriculture, construction etc.)

- Lending for specific types of real estate (multifamily housing, manufactured homes, etc)

- Products targeted at affinity groups (military, retirees, etc.)

- Niche insurance products (commercial equipment, Occupational Accident, etc.)

More standard products like basic checking accounts or car loans will often be targeted to nearby locations.

Ads for housing and credit-related offers can target by county, city, and radius. Offers unrelated to housing and credit can also target by zip code, as shown in this example.

For services like investing and wealth management, banks can target nearby affluent locations. In this table you can see zip codes near the firm’s office, sorted by how far they are from the office. Data on income brackets and average home price has been appended from the IRS and Zillow respectively. The bid adjustment column determines how much we will spend in any zip code. Obviously, the closer and more affluent a zip code is, the more aggressively we would target the area.

Demographics and Recent User Behavior

Demographic targeting can be layered on top of the previously mentioned options. This includes age bracket, gender, income bracket, homeowner status, and education level.

Recent user behavior can also be taken into account. This includes people who have recently done relevant searches and visited relevant web pages, as well as people who have visited your own website.